In the accounting and finance field, a binomial tree is a crucial tool. It is a form of a graphical representation of intrinsic value forecast. The varying values may take up different node places in the tree that often represent a time period in the future. The stock or bond (for which we are forecasting) defines the value of the tree node at a time.

The value also changes based on the probability of the increase or decrease in the price of the assets related to eh stock or bond. In financial terms, under the binomial tree model, every node/option’s value depends on the financial instrument used for calculating the forecast price of the stocks/bonds.

Did you know that, in 1970-71, the taxation was divided into 11 brackets, with the biggest band incurring a tax rate of 85 per cent?

In Addition, the use of nodes in a binomial model depends on the current market price of the asset. Hence, the price may increase or decrease depending on the market conditions and other economic factors. Let’s learn more about this model with a binomial tree example.

How Does a Binomial Tree Function?

It is an essential tool for individuals/teams who want to calculate the fund value but with price embedded options. A binomial tree works based on the current industry and market prices in various countries. Developing this model is easy. However, the model may only predict within a single time period when calculating the value.

The asset's worth can only be calculated for only one possible value at a time. Still, the upside to this is that the asset worth can be calculated accurately as the outcome can be any value within a vast range. When compared to other finance models, a binomial model can handle many economic variables for calculating the price value.

Hence, it is a useful tool to finance and accounting teams. It works on an understanding of finance values and economic variables that may arise within a time period and is also effective for calculating fundamental values with no variables at all. Therefore, a binomial tree can be used with an American option.

This model is also useful for calculating the value of a Bermudan option which allows limited exercise and only for set time periods.

In 2020, Apple Inc. had a market capitalization of over Rs 164 billion. This is greater than the aggregate market capitalization of the BSE 500 businesses and doubles the market capitalization of the 30 equity market price. - Economic Times

All financial charts must be calculated and prepared by finance and accounting majors. Learners in the discipline of accounting and finance must be well-versed in a variety of ideas. Grab accounting and finance assignment help with professionals in the industry to improve your abilities. To get going, fill out the enrollment form.

What are the Uses of a Binomial Tree?

A binomial model is a useful pricing model for tracing option keys in different time variables and discrete time intervals. Implementing this model is called a lattice for various time steps in the finance model, including the valuation and expiration dates. Every node on the binomial model represents an underlying price value at any given time in the future.

Calculating the value using the binomial tree is an example of interactive accounting methods. You can see the expiration date and other time intervals at each node on the tree. You can compute backward from the first node (valuation date) in the lattice to any date before the expiration.

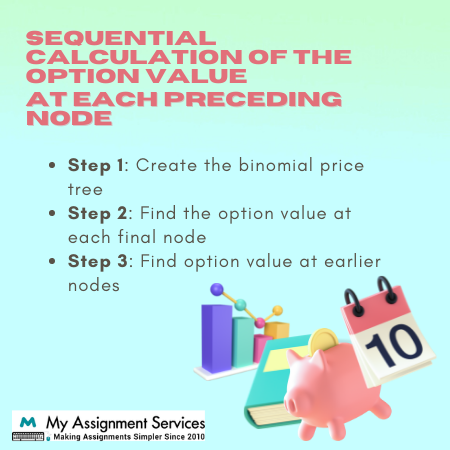

Remember that the calculated value at every node at any given time becomes the value option at the respective time unless changed in the future. The valuation of a binomial model has three steps :

- Developing a price tree

- Calculating the option value of each node in the binomial model

- Computing the sequential option value at each preceding node

Between 2019 and 2020, Various Australian businesses spent more than 15,000 AUD solely on research & development - ABS (Australian Bureau of Statistics)

We’ll further understand these steps in the next section of the blog. A binomial tree has extensive implications and uses in the accounting and finance sector. As an accountant, you must be able to develop one yourself. If you still feel confused, let’s discuss it in detail, shall we?

What are the Steps for Creating a Binomial Interest Rate Tree?

Follow these steps to create your binomial tree:

- Take note of the applicable security's current market interest rate (derivative or bond).

- Calculate the likelihood of the risk premium going up or lower. In most circumstances, the additional interest percentage is calculated using the uncertainty probability (i.e., the chance of future events balanced for risk).

- It's worth noting that if the likelihood of a rise in interest rates equals p, then the frequency of a fall in interest rates equals p. (1-p). Furthermore, the risk-neutral certainty can be used to forecast interest rates over a wide given interval of time periods.

- By using assumption, estimate forward (prospective) interest rates.

- Design a binomial model with the bond yields you've gathered. The model should at least include the binomial interest rates for more than one time period.

So this is how you develop a binomial model. It's worth noting how other binomial trees, the market rate of a product or its counterpart, must be determined in reverse regarding the binomial exchange rate tree. Put another way; we must first compute the investment performance for the most recent periods before calculating the values for past years.

What is a Binomial Tree Example?

Here’s an example of a binomial tree interest rate calculation:

Suppose we assume that the stock values a hundred USD, the alternative strike price of 100 USD with an expiration date of one year. Also, 'r' or the interest rate can be assumed at 5 per cent.

At the financial year's conclusion, with a fifty per cent probability, the stock may rise to 125 USD and the other fifty per cent probability of it decreasing by ten dollars, making it $90. For the stock value to increase to the option value is 25 USD [difference between the stock price ($125 )and the strike price($100 )], and if the price drops, then it will be a loss and not worth calculating the interest rates.

To calculate the option value, we proceed further like:

Option value = [(interest rate rise probability* increase value) + (interest rate drop probability* decrease value)] / (1 + r) = [(0.50 * $25) + (0.50 * $0)] / (1 + 0.05) = $11.90.

So this is how we calculate the interest rate increase, drop or rise in a binomial tree. It is essential for accounting and finance students to get a firm hold of such calculations as these are part of their professional ventures. Hope this blog informs you about the market price calculations and how to conduct such calculations yourself.

Learners in financial accounting are given various assignments, such as classwork, report writing, research papers, and so on. Due to a shortage of experience, you may feel some of these tasks are tough. Fill out the enrollment form to get expert accounting and finance assignment help and the availability of free educational resources. Enrol now.