Budgeting is a term we are all familiar with; we hear it at each month's beginning and end. Be it a family budget or a personal spending limit, budgeting is done by families, individuals, and businesses. From experience, we learn about the importance of planning, monitoring, and holding our spending.

Did you know that 'budget' originated from the

French word bougette, which means a little bag?

The purpose of creating a budget is to save money and spend wisely; the same is the case with an organisation's operating budget. In the unit, FNSACC412 Prepare Operational Budgets, you will learn the knowledge and skill required for planning and documenting operational budgets at the industrial level.

The key learning of the unit is useful for individuals who want to learn specialised and systematic strategies to monitor the finances of a business. Basically, you will learn how a business creates its budget. Small to large-scale organisations have huge amounts at stake, at least anything more than an individual's monthly budget.

Read forth to learn more about preparing operational budgets through examples to help you get started.

Why Do Businesses Need a Budget Plan?

Planning and a realistic budget are essential for managing the finances of an organisation. Budgeting provides enough data and industry insight to help businesses operate through the means, increase profit and manage unexpected challenges. A perfect budget comprises the availability of capital, expenditure estimation, and revenue calculation. Proper budget planning is required in a business for:

Tip: Transforming your variables into a fixed budget

can help you save a lot of money, and the miscellaneous

expenses will decrease.

Setting Realistic Business Goals

The finance plan in a business always includes miscellaneous and deficits; the reason for doing so is to make realistic plans and consider all the variables. The same is true in operational budget planning, and you get more insight about it in FNSACC412 - Prepare Operational Budgets.

Making Good Business Decisions

Market failure is often an unplanned event, but it can be avoided by making an adequate number of effective business decisions. Planning a budget is also one of such decisions that help businesses grow.

Get Finance

The main purpose of operation budget planning is to reduce expenses and increase revenues. Such a plan helps businesses stay operational for years to come and even in adverse market conditions.

Preparing a budget is the task of the accountant or bookkeeper in a company. But it’s the manager’s role to monitor the plan and ask important questions. Basic financial and accounting knowledge is required for checking the budget’s accuracy and keeping it updated. Check out the attached FNSACC412 prepare operational budgets examples to help you prepare budget and finance statements.

The field of accounting and finance go hand in hand, and sound knowledge in accounting helps you manage finances and vice versa. At the same time, it's quite difficult to know both of these by heart. Hence you may find your assignments hard. Get accounting and finance assignment help from subject-matter experts. Fill out the enrollment form to get started.

What Are the Different Types of Budgets?

Although the task of creating an operating budget for a business is complex, even the most basic step, a budget plan, compares the organisation's earnings with its spending in a period. Planning the various expenses and calculating the sales are only a minor part of the budgeting process. Other factors - predicting expenditures, ongoing cash requirements and revenue losses are a few other factors. Depending on these factors, budgeting is divided into three subcategories.

The overall operating balance of the Australian

government rose from 39 to 54 billion AUD in

2021. - ABS

Master Budget

Almost all businesses start with something called the master budget; it projects the company's overall finances. Master budgets forecast the whole fiscal year, including predictions for income statement items, cash flow, and the balance sheet.

Static Budget

The fixed expenses of a business fall under the static budget, which includes fixed input and output units of the company's different departments. It determines how much capital the company has and what amount it can spend.

Operating Budget

The daily revenues generated in the business operations of the firm fall under the category of the operational budget. It focuses on the expenses required to keep the various operations running, the cost of sold goods, income, and revenue.

These three categories are the major budgeting decisions an organisation has to make. All three of them are equally important for the business's success and to keep it running. Sound knowledge of the various budget types helps managers gain financial information by analysing the budget variances that support well-informed business decisions.

What are the Steps for Preparing an Operational Budget?

Curating an operational budget is an essential business procedure. An operational budget monitors the costs required for keeping the business running. The material cost, machinery, labour, storage, transportation, utilities, supervision and administration are included in this. Here are the steps to create a budget:

In 2016, average Australian households' expenses were over 600 billion AUD on basic living expenses. - Moneysmart Australia

Step1: Identify Expenses

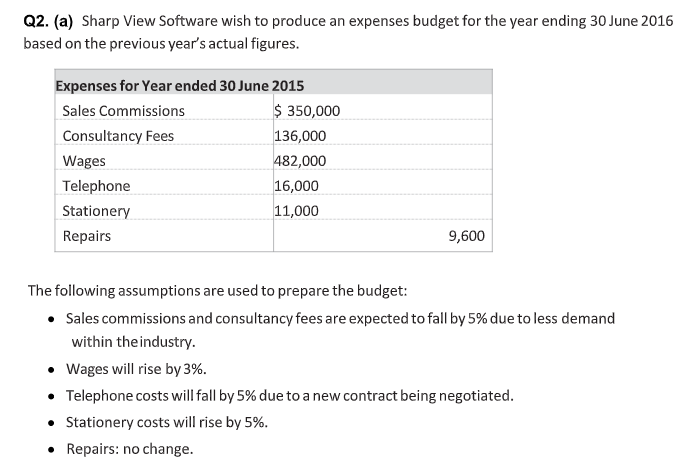

Analyse all the business expenses, including the property tax/rent, transportation, storage, and administrative costs. The money used in keeping the business operations will also be included in the overall expenditure.

Step2: Identify Production

Calculate the number of units to be produced as well as the number of units sold. Adding up these two will give the total inventory turnover; doing so is important for keeping up with the business trends.

Step3: Divide Expenses by Production

Dividing the expenses by production gives the cost per unit. The production cost per unit is important to calculate the apparent number of goods and services.

Step4: Determine the Revenue

Refer to the total number of units sold and calculate the overall revenue for the business, comparing it to the capital before expenses. Such a calculation gives the gross income unit for the budget.

Step5: Cost Per Unit Minus the Revenue Per Unit

Subtracting the cost of each unit from revenue per unit gives the value of the profit margin for each unit. If the value comes out to be a negative integer, increasing the cost or reducing the expenses will increase its value. If the resulting number is a positive integer, it is utilised for calculating the profits and future revenue.

These are the steps to be followed when creating a budget. Businesses use operational budget planning to plan their spending and forecast expenses. It is a necessary practice in the business world to help businesses maintain a static budget that keeps the business afloat and running smoothly. You can get more insights into the unit through FNSACC412 Prepare Operational Budgets.

Accounting, finance, and economics are closely knit subjects and often fall under the same umbrella. Students pursuing these courses need to keep up with the ongoing trends and issues in the sector of their academia sector. Get accounting and finance assignment help from professionals to get expert insights on various concepts through a live guided session to enrol today.