5 Things About Mortgage Loans In Finance

Expert Academic Assistance Since 2010

- Assignment

- Homework

- Dissertation

- Thesis

- Coursework

- Essay

- Case Study

- Discussions

- Report Writing

- Research

Get a Quote & Save 30%

Book All Semester Assignments at 30% OFF!

Order NowExpert Academic Assistance Since 2010

Get a Quote & Save 30%

Table of Content

There might have been times when people require urgent cash. In those moments of crisis, being a homeowner is not less than any boon; simply applying for a mortgage loan is what can do wonders when in this situation. Mortgaging a property or any other expensive asset such as gold, car etc yields amazing returns as loan.

As a finance student, you might have come across many different types of loans such as personal loans, small business loans, home equity loans, credit card loans, mortgage loans and more. Among these, mortgage loans are the most beneficial for users. The reason behind this is when one takes a mortgage loan, he/she doesn’t have to bequeath the property ownership. Also, it is way easier to get the loan at a comparatively lower rate of interest in comparison to the other types of loans. Just like this, there are many other things that are not known to most of the people. For those of you, our finance assignment help will equip you with all you need to know about mortgage loans in finance.

There has been a tremendous change in the Mortgage in America. The era before the Great Depressions witnessed mortgages that had short maturity times as well as users needed to pay a large down payment for it. Also known as the Pre-depression mortgages, they characterised variable interest rates that had to be negotiated annually.

With the pressing needs of loans in today’s present context, mortgage loans have come as a rescue for a large number of people nowadays. Thus, it becomes imperative to know everything about mortgage loans as a finance student. Don’t worry, we will help you in this venture.

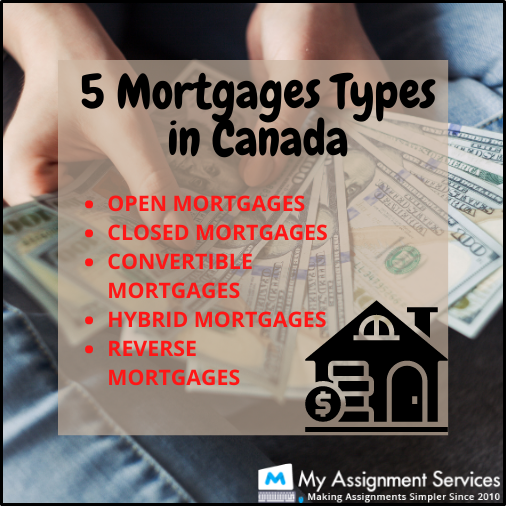

These are the five types of mortgages that you can take in Canada. Now, proceed further and understand all that you need to know about mortgage loans in finance.

If we look at the evolution of mortgage loans, we would see it first in the time when the barter system had been started. People used to exchange a wide range of goods and services in return for what all they needed. For instance, exchanging some amount of crop for buying a hen so on. This was when money was not invented.

After the invention of money, people started pledging for their property in exchange for money. And when they would pay off the money, they would get back their property. Started from borrowing money from the richest person in an area, it later reached to co-operative societies and then to government-recognised banks. Today, every financial institution provides different types of mortgage loans.

There are different ways of paying off mortgage loans. Being a finance student, it is imperative for you to be aware of them. Broadly speaking, our finance assignment help experts categorise the types of interests for mortgage loans into two main categories.

These are:

When we opt for paying off the mortgage loan at a fixed rate of interest for the entire tenure of the loan, it comes under a fixed rate of interest. However, this is applicable to only those mortgage loans that have shorter tenures. In case, you want to take a mortgage loan for a long period of time, then it is not possible to pay it off using a fixed interest rate.

This type of interest rate is dependent on market rates. A user who wants to pay off the mortgage loan using the floating interest rate doesn’t usually know the exact rate of interest but can have a fair idea of the existing interest rate from the website of the lender. This can vary depending on the rates prevalent in the market. The deciding factor for this is the Marginal Cost of Funds based Lending rate (MCLR).

These are the different types of interest rates for paying off mortgage loans.

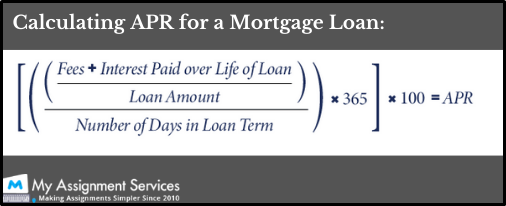

APR stands for the annual percentage rate and is not same as the interest rate for the mortgage loan. It is the total cost of a mortgage. This overall cost includes several other costs like closing costs, interest rates and more that comes within the loan tenure. One of the most important things that you need to know about mortgage loans in finance is calculating the annual percentage rate (APR).

This is the formula that our finance assignment help experts use to calculate APR for a mortgage loan. It is significant for the lenders to disclose the annual percentage rate due to the Truth in lending act.

It is the value of the house of the borrower compared to the loan amount that you owe in the form of a mortgage loan. For example, if the amount of your home is $200,000 and you have taken a loan of $180,000, in this case, the loan to value would be 90%. This value is helpful for lenders to calculate the risk.

Another thing that you need to know about mortgage loans in finance is some features that would help you distinguish these loans from other types of loans.

So, this is it. This is all you need to know about mortgage loans in finance. We have imparted all the requisites that are needed to write flawless finance homework assignment with ease. In the last ten years, we have tried our hands over a variety of assignments and created a large repository of reliable samples for you to hover over and use while writing your own assignments.

Let us present one such assignment file here.

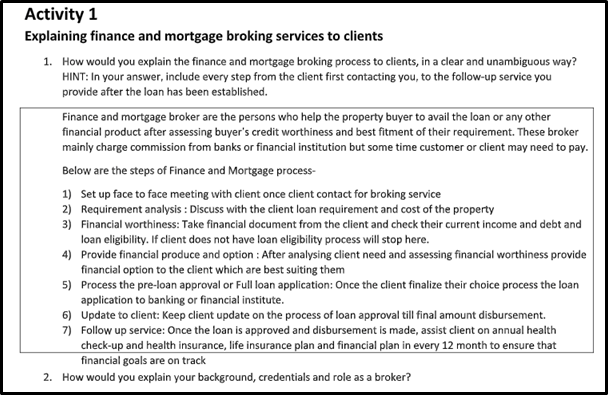

Here is a mortgage loan in the finance assignment question received by our finance assignment help experts from students.

The main objective of this assignment is to explain the finance and mortgage broking process to clients. In addition to this, we also need to highlight the background, role and credentials as a broker.

This is how we have written the answer to these questions for students.

Now that you know everything about mortgage loans in finance, it won’t be much of a problem for you to complete such homework assignments on your own. If you still feel perplexed, then you are always welcome to get in touch with our experts via the live one-on-one sessions and get the answers to all your queries instantly.

In the last decade, our finance assignment help experts have emerged as industry veterans in this field. There has not been any stone which is left unturned from our end. My Assignment Services is an age-old firm that takes pride in bringing students closer to their dream grades by handing over high-quality work to them.

Over these years, we have worked upon every aspect that has become a hurdle in the path of student success. Through our new mobile application, it is possible for you to track each step of your assignment writing process sitting right at your homes. There’s a lot to grab from us. Just get in touch with us and stay up-to-date with all our new discounts and offers!

Prev Post

The Booming Age Of Digital Marketing: Impact On Marketing Assignment Writing!

Next Post

Online Mathematics Homework Increases Students’ Achievement

© Copyright 2010 - 2025 Assignment Help by My Assignment Services. All Rights Reserved.

Please Wait..