Asset Valuation or Valuation of Fixed Assets is a simple process that revolves around assessing the true value of a financial corporation particularly the assets that support its cash flows. These assets are an important source of generating operational revenue, hence there is a constant need for properly valuating them. Fixed Assets are those assets which a company may hold for a certain period of time and for the purpose of producing goods or providing services apart from the normal course of its businesses.

This is an essential part of the assignments handed over to the finance students and in most cases, they find it a tricky task to accurately evaluate the assets of a company. Thus, it is advisable to take help from a Valuation of Fixed Assets assignment help subject expert and get the work written in the most efficient manner from them.

Three Methods of Fixed Asset Valuation

Common methods that are used in the process of valuation of assets

Acquisition Method of Accounting

This method focuses on the acquisition cost which is more commonly known as the cost of acquisition. It is the total cost achieved after adjusting for incentives, discounts, and other necessary expenditures. The company then recognises this cost on its books for the fixed assets such as equipment and property. Our experts help you to completely understand the core concepts in Valuation of Fixed Assets assignment help.

This method and its steps are perfectly explained by our experts of Valuation of Fixed Assets assignment help in a simple language which becomes easier for any student to understand.

We will now list the steps in acquisition method of accounting by using GAAP approach:

- Measure any tangible or intangible assets acquired by the company

- Measure any intangible or tangible liabilities acquired

- Measure the amount of gain or goodwill on a particular transaction

- Measure the consideration paid to a seller

Replacement Cost Method of Accounting

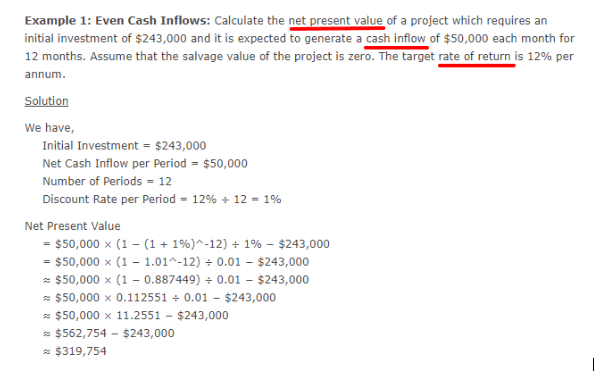

It is a simple method which states the cost that arises when a company replaces one or more of its assets at the equal value. The only variable here is the actual replacement cost which could depend on the changes in the price of that particular asset in the market. Companies use the net present value (NPV) to come to a decision of purchasing the new asset. Our Valuation of Fixed Assets assignment writing services provide you a detailed explanation of how and why most companies use NPV as a part of the replacement cost method. The online Valuation of Fixed Assets assignment experts say that a company will heavily consider the cash inflows, which is basically the revenue generated by its increased productivity, and also, the cash outflows which is the expenditure on the purchase of the new asset. Both these cash inflows and cash outflows are adjusted to net present value and the discount rate, before making the final decision.

Accumulated Depreciation Method of Accounting

This is another method for valuation of fixed assets where many accounting students get stuck. In our Valuation of Fixed Assets assignment writing services, we have explained this method in a simple manner with accounting assignment help. As you already know that an asset will lose its value over a period of time, and this loss of value is known as depreciation. Our online Valuation of Fixed Assets assignment writing experts say that this the reason why depreciation is always included as an expense in the balance sheet of a company. There are two approaches to use this method as discussed in the online accounting assignment writing services provided by our team of accounting experts - straight-line method and declining balance method. We will show you how and in what circumstances should one use each of them.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

Valuation of Fixed Assets Assignment Samples for Valuation of Fixed Assets

To help you get a clearer understanding of the tricky accounting concepts such as those in fixed assets valuation, our team of Valuation of Fixed Assets assignment help provides you some Valuation of Fixed Assets assignment examples.

The first example is about the replacement cost method that we have already discussed above. Here, our accounting assignment writing experts first calculate the discount rate per period on the basis of target rate of return, which is already provided in the question. By using the formula, they finally arrive at the NPV of the company.

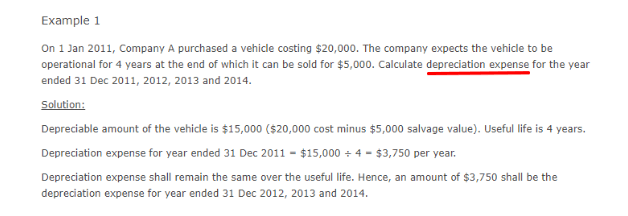

The second Valuation of Fixed Assets assignment sample question provided by our experts is about the accumulated depreciation of accounting. The two most common approaches that these accounting assignment online experts use are straight-line method and declining balance method.

Straight-Line Method

This is the most common method where the total cost of a fixed asset is reduced in a uniform way over its entire useful life. This is until the asset reaches its salvage value. Our Valuation of Fixed Assets accounting assignment help have explained this method with proper steps which includes the determination of the cost of the asset, determining the useful life of the asset, subtracting the salvage value of the asset from its total cost, and finally arriving at the required depreciation amount at the end of this process.

To answer the given question, our experts first calculated the depreciable amount of the vehicle. Then, they found out the depreciation expense for the current year. On the basis of these two findings, the final depreciation amount using this straight-line method was calculated.

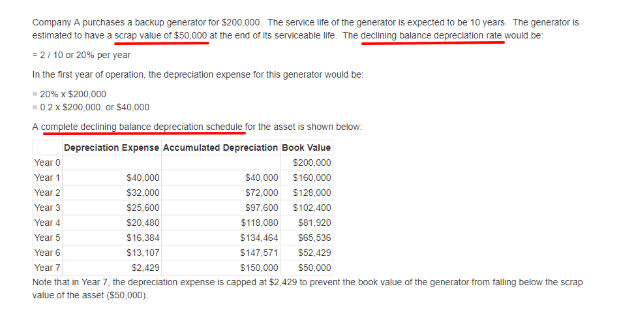

Declining Balance Depreciation Rate

This method involves the application of the depreciation rate against the non-depreciated balance. The resulting declining depreciation rate is due to the asset being depreciated at a constant rate throughout until its useful life.

In this Valuation of Fixed Assets assignment example, our Valuation of Fixed Assets assignment writing experts calculate the total depreciated value by using a table showing the amount depreciated in each year. And, at the end of the 7th year, the final value gets realised.

Why Should You Choose Our Valuation of Fixed Assets Assignment Online Help?

My Assignment Services is the most affordable and reliable academic service provider for Valuation of Fixed Assets Assignment Help. We have an excellent customer service that works round the clock and all days of a year. You can contact our customer care executives and they will address all your queries and concerns and provide you with the most convenient solutions

We understand that accounting assignments such as assets valuation or valuation of assets can be a tricky task to do. This is the reason that our valuation of fixed assets assignment writing experts strive to provide round the clock services to our customers, which, are the students. With our unparalleled knowledge of accounting concepts and terminologies, we are your go to place for Valuation of Fixed Assets online Assignment Help.

Our top most priority is your satisfaction and we can provide an initial draft of your assignment. Your inputs are our command; our experts will tailor the assignments as per your suggestions. We will make any number of revisions to ensure that our customers are fully satisfied with our work. To add to that, we will facilitate one-on-one conversations with our experts so that you can directly communicate your requirements to them. Our experts will answer all your questions and clear all doubts that you might have on your assignment.

Our online accounting assignment help service is 100% authentic and plagiarism-free. We also provide a free plagiarism report along with the assignment which proves that your work is entirely genuine.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

Get It Done! Today

1,212,718Orders

4.9/5Rating

5,063Experts

Highlights

- 21 Step Quality Check

- 2000+ Ph.D Experts

- Live Expert Sessions

- Dedicated App

- Earn while you Learn with us

- Confidentiality Agreement

- Money Back Guarantee

- Customer Feedback

Just Pay for your Assignment

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

Free- Let's Start