A combination of various accounting methods focused on tax payments and returns is called taxation accounting. Today’s business environment is extremely complex and with the increasing dominance of information technology, there is more demand for transparency. With this, organisations as well as individuals are under increased pressure because they have to be highly accurate while filing their tax returns. This is precisely what a tax accountant takes care of. They are responsible for accessing the clients’ statements, calculating their earnings and preparing tax statements to be filed with the Australian Taxation Office (ATO).

To train tax accounting students for the challenges they will be facing in the real world, universities are handing out complex taxation assignments. Because these assignments are time consuming and students have a lot on their plates, they feel compelled to seek online taxation assignment help. These assignments focus on a wide range of questions, which call for a complete understanding of Australian taxation laws. Thus, what students actually require is accounting assignment help by Australian writers .

My Assignment Services has an in-house team of tax accountants, who are dedicated to provide tax Accounting Assignment Help to students. Our experts, having worked with multinational corporations, hold a thorough understanding of current tax laws. Our tax accounting assignment help service has delivered a lot of solutions in the past. We will cover some of the most commonly asked tax accounting questions to help develop a deeper understanding

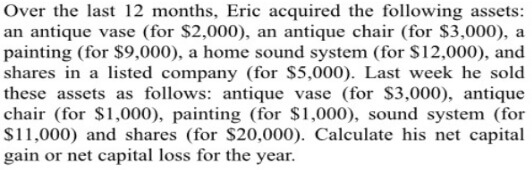

In the below problem, Eric had acquired a few assets over the year. He, then, sold those assets, some for profit and some at a loss. The question is to figure out what was Eric’s net capital gain or net capital loss.

A person makes a capital gain or loss if they dispose an asset through sale. Any net capital gain they made should be included in their tax return. Net capital gain is the total capital gains for the year minus any capital losses and concessions. On the other hand, net capital losses cannot be used to reduce a person’s assessable income for that particular year. But, they can be carried forward and can be offset against any capital gains the person might have in the future years.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

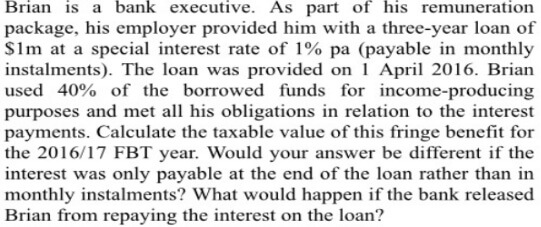

The Fringe Benefits Tax (FBT) is paid by employers for the benefits they have provided to their employees or their employees’ associate or family. These benefits might be a part of their wages or could be an added benefit. FBT is different than income tax and is calculated on the taxable value of the fringe benefits provided. Fringe benefits could include things like company car or car parking, private health care, etc

Ouronline taxation assignment help experts have a comprehensive knowledge of all types of taxes in Australia. For example, Goods and Services tax (GST), income tax, withheld tax, fringe benefit tax, net capital gains or losses, simple tax etc. We have also provided assignments based on superannuation, property tax, payroll taxes, and taxes on inheritance

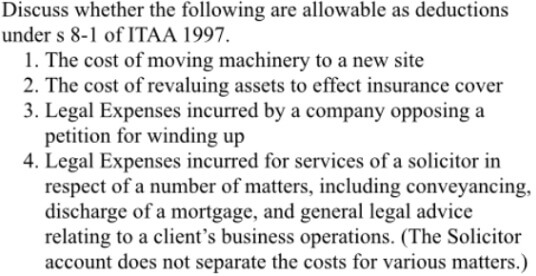

The above question, for example, requires applying theoretical knowledge of various tax rules, deciding if the above expenses are deductible or not, and calculation of the deductions, wherever applicable.

Our Taxation Accounting Assignment Help experts hold a complete understanding all tax rules and are well practiced on the calculative part of such problems. Thus, you can leave the assignment up to our experts and rest assured that we will leave no stone unturned and provide you with the perfect taxation accounting solutions

Assignments can also be based on preparation and administration of tax documentation for either individuals or legal entities. These types of assignments might contain different parts like writing reports and making presentations, involving role play, case study, etc. Our Taxation Accounting Assignment Help experts can provide all such solutions even within the shortest of deadlines.

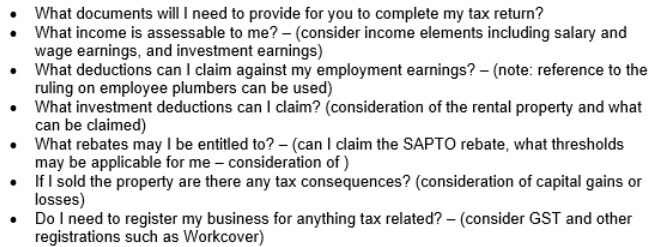

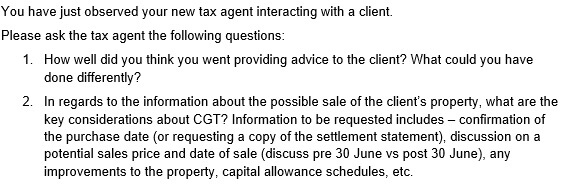

The below assignment, for example, to discuss taxation issues with a new client and the preparation of the required income tax returns for the current tax year. This assignment encompasses the gathering and verification of data, calculation of the individual’s taxable income, and the review of compliance requirements. The assessment contains two types of assignments, a presentation including role play and evaluation, and a written report which requires a comprehensive case study.

The student is required to work on the assumption that he is a taxpayer and have recently commenced a new plumbing business in his personal name. He has been referred to a new tax agent, who will be assisting him and will be answering the below questions.

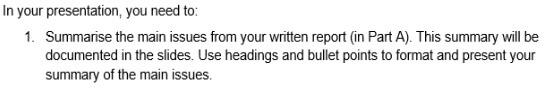

The student has been asked to make a presentation including answers to the above questions and also include general information about the client, like client’s background, family members, and other taxation matters that seem relevant to the case.

Part B of the assignment included writing a report from the perspective of a senior tax agent on the performance of the tax agent in the previous part.

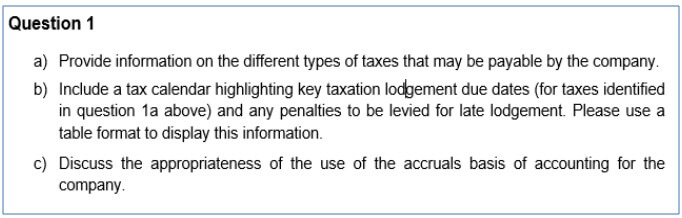

Another solution we have provided in the past included writing an assignment as the CFO of a company. Part A of the assignment was writing a report. The report should contain the tax plan for the company, which optimises the tax position for the company and also an upcoming ATO audit. The company had received a notification from the ATO with regards to a scheduled audit. In the student’s report on the ATO audit and the tax plan, they were asked to address matters raised by a few questions. We are sharing a sample question for reference.

Part B of the assignment included making a presentation based on the report written in part A of the assignment.

Our taxation accounting help experts have provided high distinction solutions to the above assignments. Their in-depth knowledge of tax accounting fundamentals and their years of experience in taxation accounting, helps them write these assignments efficiently and accurately. They have a deep understanding of university specific guidelines and marking rubric.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

Taxation accounting assignments entail complex calculations and a lot of points need to be kept in mind while writing such assignments. Small details, if overlooked, can result in huge discrepancies in the solution.

Missing information or income from one’s tax returns is a huge mistake. Hence, students should make sure that they include all relevant information while calculating tax returns for your assignments

Inaccuracy is another common mistake made by accounting students. While doing your assignments, accurate figures should be used whenever you mention income or deductions.

While writing assignments, students sometimes leave out overseas income. Overseas income includes capital gains on overseas assets, employment and investment income, etc. These should all be factored in the calculation of tax returns

Our Tax Accounting Assignment Help services pay attention to even the smallest of details while providing assignments. We can assure you that our accounting assignment assistance for Finance students is unparalleled

My Assignment Services is the best provider of Tax Accounting Assignment Help . We have an excellent customer service. You can contact our executives 24*7 and they will address all your queries and concerns.

We understand that taxation accounting assignments can be cumbersome. This is the reason our assignment writing expertsstrive to provide round the clock services to our customers. With our unparalleled knowledge of Australian taxation laws, we are your go to place for Tax Accounting Assignment Help.

Our top most priority is your satisfaction and we can provide an initial draft of your assignment. Your inputs are our command; our experts will tailor the assignments as per your suggestions. We will make any number of revisions to ensure that our customers are fully satisfied with our work. To add to that, we will facilitate one-on-one conversations with our experts so that you can directly communicate your requirements to them. Our experts will answer all your questions and clear all doubts that you might have on your assignment.

Our online taxation assignment help service is 100% authentic and plagiarism free. We also provide a free plagiarism report along with the assignment.

You can reach us via call or email and avail our affordable assignment writing services

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeBonanza Offer

Get 40% Off *

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....