Accounting and especially the taxation subject usually creates a lot of problems for the students in Australia. The amount of calculation, formulas, and even crucial theories involved in the subject terrifies the students. The process of tax return filing is a crucial aspect and as professionals, the students will be responsible for calculating the right taxes during their future endeavors. Hence it is necessary to avail the besttax return assignment helpif you are not well-versed with the subject from My Assignment Services

As a student, you need to understand the formulation of all the rules and regulations associated with the tax return and follow the same while filing the same. However, considering the complexities and vastness most students in Australia fail to connect them with the subject. For this reason, only we provide the besttax return assignment help online so that they will feel completely covered.

We know most students feel stress while writing their tax return assignments, due to a lack of understanding and even calculation skills. if you are one among them and looking for writing impressive tax return assignments then don’t get late to avail ouraccounting assignment help.We have a team of exceptional writers who are experts in the field and guarantee you the best-quality writing every time. They are also cognizant of your university guidelines and marking rubrics, so availing the best grades would not be a far way from availing of our assignment writing services.

On the other hand, if you are under a time crunch due to a myriad of academic obligations and looking for the best way to overcome such difficulties then consider ourtax return assignment help onlinethrough guided sessions without looking anymore.

My Assignment Services is the perfect place for you to avail the best tax return assignment help and you can avail an elaborated and exceptionally written assignment on a tax return. We assure you that it will not only render you the best grades but also impress your professors. By availing our services, you will be able to meet the strict guidelines of timely delivery and best-quality writing, so overall it will be a win-win for you.

A tax return is a form that reports the details of income, expenses, and also relevant tax information. The process helps the taxpayers to generate their tax liability, tax payment schedules and also provide information on the refund process. It also calculates the income of a business with the tax charges that it needs to pay to the government. The taxes accumulated in this process are usually meant for the infrastructure, education, and military of the country.

In 1862, Abraham Lincoln first granted some money for assisting people who had injuries during the civil war. In 1894, Wilson Tariff Act delivered an awareness on income tax. However, it was Reagan who passed the Reform Act of tax in 1986 and the tax return file developed electronically in 1992.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

In Australia, the rate of GST is around 10% which is a complicated tax for most businesses in the continent.

The companies in Australia need to pay tax on their profit and it is planned at the percentage of 30.

It is one of the most crucial sources of revenue in Australia and the federal government imposes the same on the employees on their income. Such tax follows a progressive technique which means the higher tax rate for higher income.

The income lists out all the income sources of the individual and the most general way of reporting the same is a W-2 form. In this section, you must report the details on wages, dividends, and even capital gains.

Deductions minimize the tax liability hence it is considered as an important section of the tax return. It includes several contributions to saving plans or even interest deductions on loans.

Tax credits are the amounts that counterbalance your tax liabilities. It mostly revolves around the caring of dependent children and parents or even education.

The amount of tax you need to pay is dependent on your residency status. At the outset, for the first six months as a resident of Australia, you are a foreign citizen irrespective of your visa status. In such scenarios, you need to pay a higher tax rate on your income and won’t be entitled to a tax-free threshold. However, once you become a resident you can avail the tax refund feature.

On the other hand, for your stay in the continent for more than 183 days then you become a resident and need to pay taxes. The residents avail a lower tax rate and get qualified for a tax-free threshold of $18,200. However, the tax you may get back depends on a variety of factors and the ATO (Australian Tax Office) has the power to formulate all these procedures.

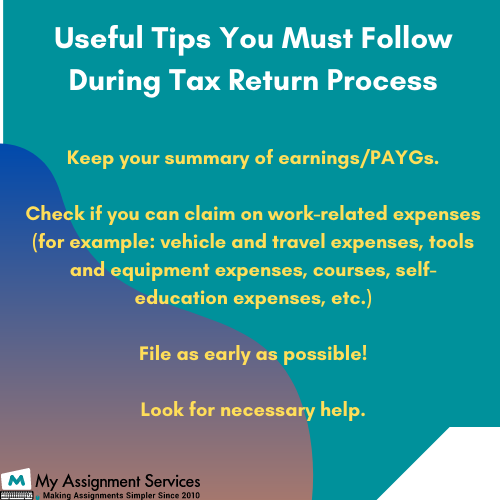

The Australian tax year completes on 30th June every year and everyone working there needs to file the annual tax return accordingly. In this, you need to declare your total earning and detail of tax paid during the ongoing financial year and claim a tax refund. The deadline for the tax return process in Australia to the ATO is 31st October, but it is always good to file the same at the earliest.

A resident Australian is required to file an income tax return in case gross income goes above a tax-free threshold of AUD18,200. On the contrary, a non-resident earning AUD or more has to opt for a tax return. The Australian Taxation Office usually issues an income tax assessment of taxable income and payable tax to the resident based on their ITR.

An income tax return is a form that is used for filing necessary information about your income to the Income-tax department. The tax amount is considered based on the individual’s income and in case the tax exceeds the income then the individuals are eligible to avail an income tax refund from the concerned department.

An effective tax return process helps the country in boosting its economy. Moreover, the government uses the collected money to relieve the affected in case of disasters. The tax receipts you get after paying the tax work effectively during the Visa application process.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

My Assignment Services is a pioneer in top-notch quality assignment writing in Australia. The company has been simplifying the assignment writing difficulties of the students for a decade. So you can avail the assistance without a second thought. Here are some of our key features that entice students across Australian universities.

While helping you withthe tax return assignment helpthrough guided sessions our experts conduct intensive research on your assignment topic. They explore various tax forms, key terminologies associated with the tax return process in Australia. Hence availing the most authentic paper from us is guaranteed.

On the other hand, by availing of ouronline tax return assignment helpyou are free to call us at any time of the day. We have a team of committed professionals who work round the clock for your convenience. So, you can get in touch with them through live chat, email, or even phone calls and share your assignment writing concerns with ease.

My Assignment Services ensure you the bestaccounting assignment helpat an affordable price. We don’t charge students unnecessarily and make every effort not to burden them with hefty prices. Besides this, we also offer seasonal discounts and promotional offers so that you can avail our assignment writing services at unbelievable prices.

We have a team of talented writers and editors who hail from renowned academic backgrounds and always stay on the verge to help you with exceptional assignment writing. They also play a crucial role in editing and proofreading and ensure the same before delivering to your mailbox. So, availing of ourtax return assignment helpwill be beneficial for you.

Therefore, join us and take ourtax return assignment helpto overcome all the assignment writing woes.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeBonanza Offer

Get 40% Off *

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....