Highlights

A share market, equity market, or stock market refers to the summation of sellers and buyers of stocks also known as shares. It indicates the ownership claims on trading. This often incorporates securities listed on a public stock exchange and those who conducted business privately. Businesses are required to provide their stocks to the general public via IPO referred to as initial public offers. Then they conduct business in the secondary market which is called the stock market.

To deliver good stock market assignments, you must be well-versed with the concepts like stock market trends, logistics regression, and determinants of the foreign exchange rate, risk management, and more which may be complex to understand. Do you find stock market assignment questions too difficult to comprehend? Are you unable to find good sources for your stock market assignments? Well, our stock market assignment help experts at My Assignment Services are here to provide you with one-to-one guidance so that you deliver your Stock Market Assignment exactly according to marking rubrics.

Our experts always keep themselves up-to-date with the stock market topics like trading techniques, factors to consider when investing, stockbrokers, and more. Hence, you will get the best assignment help from our stock market assignment experts.

A stock market is defined as the collection of the sellers and buyers of shares or stocks. These shares indicate the interest of ownership in industries and businesses. It also includes privately and publicly traded securities. Generally, large industries will enlist their stocks on a stock exchange as it makes their stocks more liquid such as easy to sell or buy, which investors adore a lot. Also, this kind of liquidity attracts international investors.

Moreover, investment in the stock market is commonly sometimes done through electronic trading platforms and stock brokerages. Investment is commonly done with an effective and predetermined investment strategy in mind. Stocks can be divided by the country wherein the industry is domiciled. For example, in 1987 Australian Stock Exchange Limited was formed after the parliament of Australia passed legislation allowing the combination of six independent state-derived stock exchanges.

Understanding the lingo is the first step to being able to learn about the stock market. Our Assignment providers have explained some commonly used phrases and words in the stock market:

In a long position, the possessor has advantages when the share or stock gains in value. The potential benefits are unlimited. Hence the “long” position is also known as “bullish”. When the share is lowered, the utmost that a possessor can lose is the amount of money they have paid for it. As it is not possible to lose anything else, it is known that the possessors have “restricted liability”.

On the other hand, in a short position, the owner expects that the price of the shares will lower in the short term. The owner buys the stocks from a possessor to set up a short sell transaction and then sell it to other investors. The owner should eventually return the shares that they buy. The owner is selling and buying the shares at a higher price and then, later on, borrows the share from the market when the price decreases. They then return the shares to the possessor.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

While learning how to value a company, assists to comprehend the nature of the stock market and business. Around each big corporation began as a small, mom- and pop- unit, and throughout development turned out into a finance giant.

For example, McDonald’s, Amazon, and Walmart. McD started as a small restaurant which no one outside of San Bernardino, California has ever listened to. Amazon started as an online bookseller in a garage. Walmart was initially a single-story unit in Arkansas. Have you ever wondered how these small industries or businesses grow from small, hometown units to three of the biggest industries in the American economy? Here you go, they have raised capital by selling stocks.

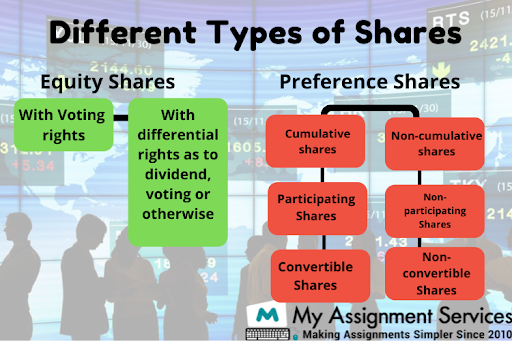

Under the stock market course, knowing stock selection and types of shares is of utmost significance and hence, our Stock Market Assignment Help experts have provided you insight into the different types of shares.

They are the most common variant of stocks that public business issues to increase capital. Most commonly, the holders of the ordinary shares get to seek advantages of voting rights, can attend annual and general meetings of a company, and are even responsible for industry surplus profits (Hornuf & Neuenkirch, 2017). It is broadly categorized into the following two types:

They hold preferential treatments or special rights, most commonly with respect to dividend capital and receipt reimbursement whenever a unit is winding up. Also, such shareholders get dividends on a primary basis, and industries return their capital before former shares whilst undergoing the mechanism of liquidation (Bunu, 2020). Following are the common types of stocks under preference shares:

Both types of shares differentiate with respect to share in voting rights, profitability, and settlement of money when a business is winding up or is being liquefied.

During the Australian Stock Market course, a student learns about several aspects of the stock market. Does this include the stock market? Why should you invest in it? How to find the right stockbroker? What are bull and bear markets and so many other topics? Assignments on the stock market need you to study a company and understand the company’s performance measurements. However, applying logical regression models, to determine any relationship between direction and predictors, and other aspects of the stock market is not a joy of joys.

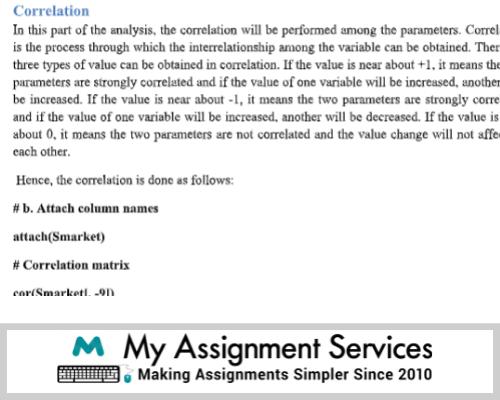

Hence, we have bought on board a team of highly-qualified and experienced Stock Market Assignment Help experts out there. Below is a Stock Market Assignment Sample provided by experts for your reference. The objective of the assignment is to plot the volume variable over time and find the correlation between the log variables.

Here is the solution to the sample question:

With this sample, you will get an idea about the quality of our services. You can analyze how our Stock Market Assignment Help experts are providing services and how they will help you get A+ grades.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

Writing a stock market assignment is not an easy task. You are required to acquire in-depth knowledge about the various concepts of the stock market to prepare a quality solution. Our experts who offer Stock Market Assignment Writing Assistance provide the following advantages:

Our expert has got your back at all times of the day. They will solve all your doubts and queries that may arise.

Our Stock Market Assignment Help are highly-skilled and experienced and are qualified from esteemed universities across the globe.

Our pricing is student-friendly so that you can easily access our services in Australia.

We provide quality Stock Market Assignment Writing Assistance such that students are able to prepare assignments that are plagiarised for free.

References

Bunu, M. (2020). Reporting of Preference Shares in the Financial Statements. https://irek.ase.md/xmlui/handle/123456789/1378

Hornuf, L., & Neuenkirch, M. (2017). Pricing shares in equity crowdfunding.Small Business Economics,48(4), 795-811. https://doi.org/10.1007/s11187-016-9807-9

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeBonanza Offer

Get 40% Off *

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....