Student often seek online mergers and acquisitions assignment help. Mergers and acquisitions are company restructuring techniques. A merger happens when two or more companies join hands, so that both the merged counterparts benefit from the combination. An acquisition, on the other hand, is an extreme form of merger where a company is taken over by another company and is incorporated into the acquiring company’s entity. Mergers and acquisitions assignments encompass two different perspectives for studying the subject, from the finance and taxation point of view, and based on legal issues and accounting.

My Assignment Services has a team of dedicated mergers and acquisitions assignment experts. They have provided numerous mergers and acquisitions assignment answers to students. They understand the various types of mergers and acquisitions, and the possible complications that might arise in such transactions. Their experience in the corporate world proves to be very useful because they understand the regulatory framework of the mergers and acquisitions laws. And the roles of the Australian Stock Exchange, Takeovers Panel, the ACCC (Australian Competition and Consumer Commission) and Australian Securities and Investments Commission.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

Our mergers and acquisitions assignment experts have a deep understanding of the impact mergers and acquisitions have on the involved parties. Their know-how of the marking rubric and university-specific guidelines is an added advantage of our mergers and acquisitions assignment writing services. Mergers and acquisitions assignments can be based on a variety of topics, like various techniques used for valuation of firms, corporate pay-outs, anti-takeover defences, the role of the Takeover Panel and the applications of the Trade Practices Act. The process followed during a merger or acquisition is outlined in the below image.

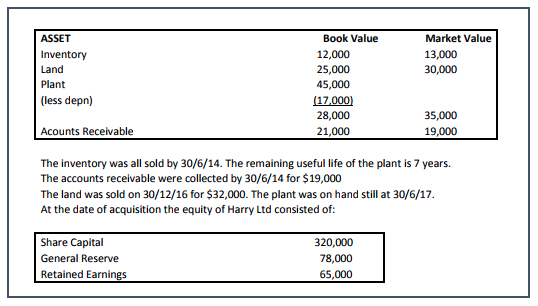

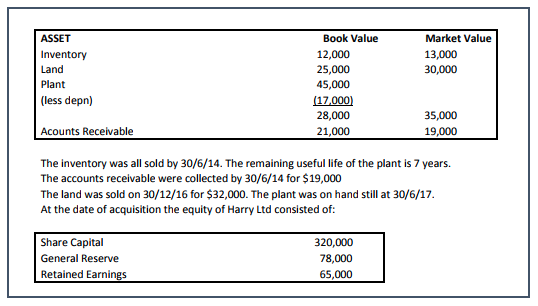

We are sharing a mergers and acquisitions assignment example, recently solved by our mergers and acquisitions assignment experts. The below assignment is a case study where all the share capital of Harry Limited was acquired by Tom Limited for a $500,000 cash consideration. With the exception of below assets, all other assets of the company were recorded at fair values.

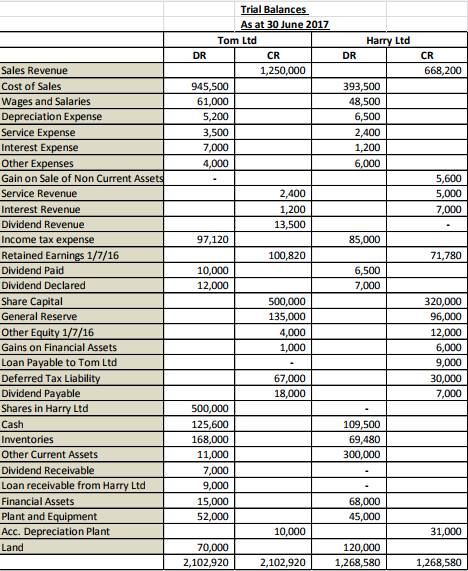

Trial balances of both the companies are presented in the below table.

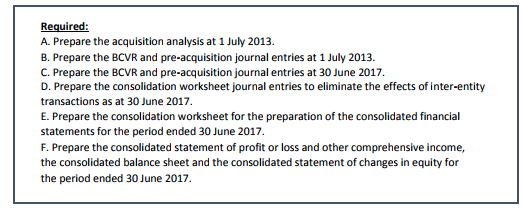

Based on the given values, students were asked to answer the below questions on the basis of some additional information that was provided.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

Our experts have been providing unmatched mergers and acquisitions assignment help to students. Their in-depth knowledge of this subject enables us to provide high distinction solutions. My Assignment Services is the only answer to your ‘do my Mergers and acquisitions assignment’ search. We can share more mergers and acquisitions assignment samples, upon request.

Customer satisfaction is our top most priority and we ensure that all assignments are quality-checked. We also provide a complimentary Plagiarism report will all solutions. Based on the student’s requirements, we can also provide an initial draft of the solution. And based on their inputs, we can facilitate multiple revisions, all this to deliver on our promise of the best assignment delivery.

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeBonanza Offer

Get 40% Off *

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....