Highlights

The term Derivative Market applies to financial instruments or a future contract that are critical to today’s investment market as it offers various kinds of risk protection, management, and strategies related to investments. Little complicated, right? Students often get stuck while making an assignment on the Derivative Market due to its complexity and technicality. When they realize that they should seek professional help for their derivative market assignment, it’s already the submission date. We are sure you don’t want to end up like those students and compromise on your grades because you’re at the right place if you’re searching for Derivative Market Assignment Help Online. My Assignment Services is the one-stop center for your Finance Assignment Help be it any topic. And for your Derivative Market Assignment Help, we have industry experts who have acquired vast experience helping students with their Derivative Market Assignment through the guided session and curating subject-oriented research and assignment content without plagiarism.

If we talk about the financial market, people usually associate it with the equity and share market if we talk about the financial market. Although the finance market is not only limited to the equity market, it is far broader than this. It includes real estate, bonds, financial instruments, foreign exchange, and numerous other assets and instruments related to finance. Recently, a particular finance tool has witnessed tremendous growth in the financial market segment, i.e., Derivatives. It has become the most crucial contributor to balancing the odds of the economic segment of the market and in the smooth operation of the real economy. Our derivative market assignment help experts believe that you must obtain a good understanding of the topics before proceeding with your finance assignments.

Derivatives are defined as a contract between a buyer and seller concerning a future transaction. It acts as a risk management and protection tool and serves the purpose of arbitrage and investment, providing multiple benefits over securities. The valuation of the contract amount depends on the underlying assets and the group of assets.

There are two types of methods used to trade in the derivative market contract: The OTC and On-exchange methods. OTC derivatives are traded among two parties without changing or any other intermediaries. OTC refers to stocks that alternate through provider networks and no longer have any centralized exchange. These are also referred to as unlisted stocks in which the securities are traded through dealer-sellers through direct negotiations. On the other hand, on-exchange derivatives or exchange-traded derivatives (ETD) are changed via an imperative business, the costs of ETDs are publicly visible. From the consumer point of view, it is also said that OTC is eight times more expensive than the ETDS.

Derivative Contracts are generally classified into four kinds. These topics are complex, but our derivative market assignment help expert has explained all these pointers in very simple words for your optimum understanding of the topic.

The option contract includes the option buyer and option seller. It gives one party the right to take or make delivery of the underlying asset. Still, when the option is given to one party, the other party must deliver the underlying asset as per the terms and conditions of the contract. The other party agreed on the risk because he received a premium amount from the option buyer.

Future contracts are made to eliminate the risk and speculation related to the underlying asset in the market. The party of such a contract agrees to buy/sell an underlying asset in the future at a particular price defined in the contract. After the agreement is made, the parties cannot back out of the contract despite the loss.

Forward contracts are similar to futures contracts only as customized contracts between two parties to buy/sell an underlying asset at a pre-decided price on a certain future date. But in such agreements, the risk is involved as the party can refrain from performing their duty.

For example: Suppose you have a retail shop of medicines and entered into a contract with a wholesale medical agency to supply you certain medicines after three months at a certain cost. The action will take place after three months, and you are free to customize the terms and conditions of the contract according to your need.

Swaps contracts are the portfolio of the forward contracts, and the parties in Swaps contracts deal in the exchange of the cash flows. These contracts also happen in the future on prearranged terms and conditions.

Did you understand the kinds of derivative contracts explained by the experts? If you’re unable to absorb any point, our derivative market assignment help expert will clear your doubts through a guided session. You can ask them any question related to your finance assignment help and get the solution for your question.

The derivatives market has efficaciously advanced beneath an effective regulatory regime. There are three prerequisites for a well-functioning derivatives marketplace:

All these prerequisites of effective functioning are fulfilled and are checked timely. Hence currently, there is not any need for structural adjustments within the framework

underneath which OTC players and exchanges operate

today, upgrades are possible.

You often get stuck with your assignment because you lack basic knowledge, and it's not your fault because universities and colleges fail to focus on the fundamentals of the subject. And as claimed, we provide unparalleled services for your assignment and learning. A Derivative Market Assignment Help expert will write your project and help you understand the various factors that will clear your basics. You can use this knowledge to score HD grades in your examination. After the guided session by the Derivative Market Assignment Help Expert, you will be able to answer any question related to Derivative Market in your class and your placements as well.

Online Assignment Help

Custom Essay Help

Dissertation Writing Service

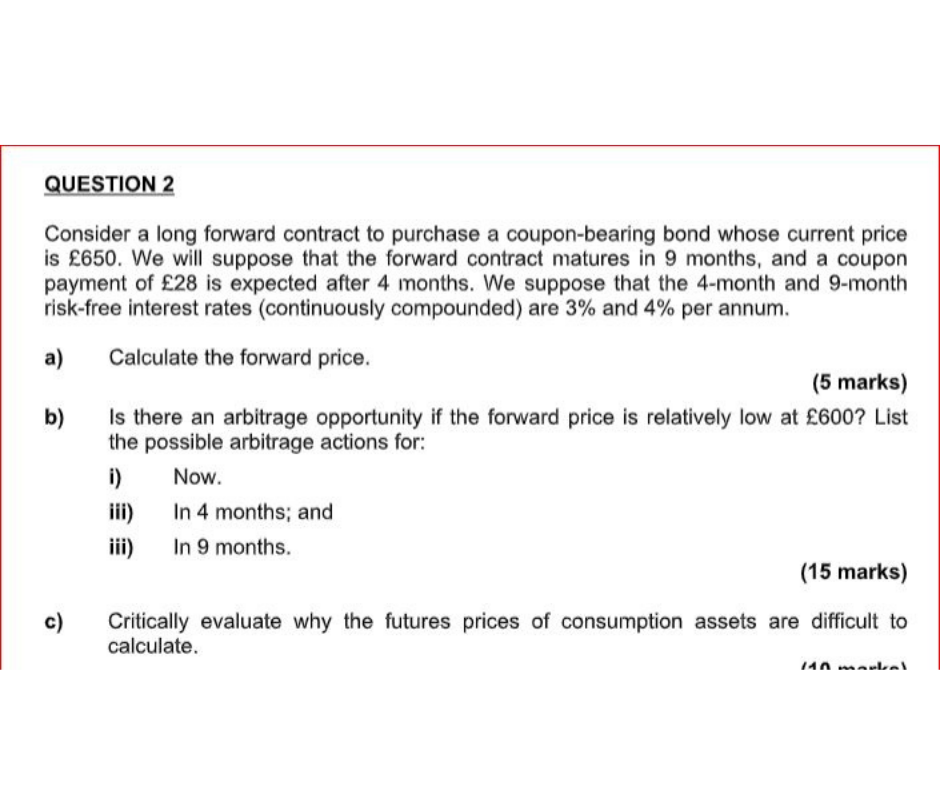

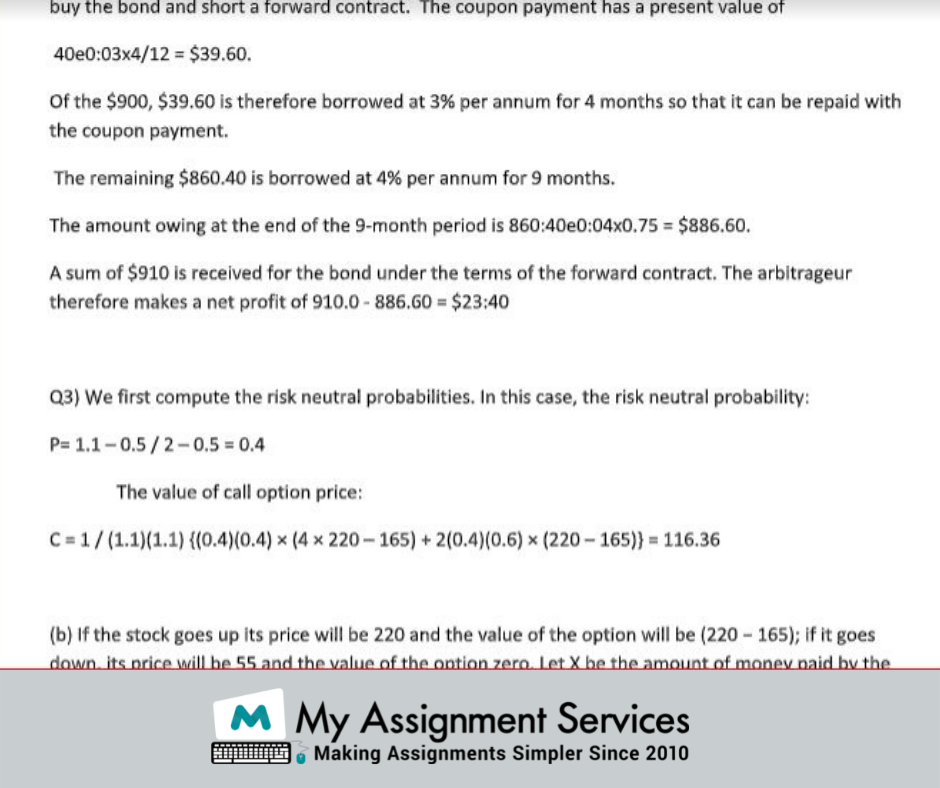

Our Derivative Market Assignment Help expert researches your topic and comes up with unmatched content for your assignment. Any assignments prepared by them are 100% authentic. Your Derivative Market Assignment guidelines, such as formatting and referencing, comparative analysis, etc., will be fulfilled with their help. The assignment is submitted with a Plagiarism report, which shows 0% plagiarism. You will have an error-free assignment at your desk. Check out the sample assignment for your reference.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

We understand that you can pay anyone for your derivative market assignment help online, but you cannot avail top quality work along with the following benefits anywhere else. These are the additional benefits of signing up for My Assignment Services.

To connect with our finance experts, simply fill out the form and avail a 10-minute session for free!

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeBonanza Offer

Get 40% Off *

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....