Accounting is an extremely vast subject which comprises tons of concepts. The most basics include accounting theories, adjusting entries, break-even point, cash flow statements, financial ratios, overheads, taxation, and more. A student pursuing accounting courses such as Diploma, Bachelor, Certificate 3, Certificate 4 and Masters of Accounting has to learn all these concepts and terminologies.

Accounting assignments are a major part of their courses that are to be submitted periodically throughout a year. These tasks are a great way for the teachers to assess how much a student is familiar with the subject and his ability to answer the questions on the basis of his understanding of those concepts. But, at times, this task of writing accounting assignments becomes a daunting task because of a number of common reasons, which are discussed later. A reliable Assessment of Depreciation assignment help will let them overcome their challenges without even worrying about how to write a quality assignment and submitting it on time.

One of the widely-used methods of accounting is Depreciation. In general terms, it refers to the wear and tear of a product over time which ultimately leads to the decrease in its value. In accounting and finance terms, we allocate a cost of a tangible asset, say a motorcycle, over its total and expected useful life. Students often consider it as a tricky concept because assessment of depreciation can sometimes become a daunting task as there are just so many methods by which the depreciated value of an asset can be calculated and most of them are tricky to understand. Assignments on depreciation make it more challenging for them because due to a limited understanding of this topic, it almost seems impossible to complete it on time. But, with our online Assessment of Depreciation assignment help, we can provide you with full-fledged solved accounting assignments on assessment of depreciation, that are written by our Assessment of Depreciation assignment experts. These individuals possess a great knowledge of this field and have mastered even the trickiest concepts.

Online Assignment Help

Custom Essay Help

Dissertation Writing Service

As we already know that depreciation does not represent a real cash flow, instead, it shows how much an asset’s value has reduced over time. An asset has certain life which is indicated in years, and in accounting terms, it can only be written off during its entire life years. Our online Assessment of Depreciation assignment experts explain this through a simple example. A company buys a motorcycle for A$ 10000. Here, it has two options to write-off the cost of this asset. Either writing off completely in year one or writing it off over the motorcycle’s useful life, say 7 years. In this example, the salvage value, or the scrapped value, or the estimated resale value of this asset is approximately A$ 1400. Lastly, an analyst calculates this motorcycle’s depreciation expense as a difference between the above two values, divided by its total useful life.

There are many methods of accounting for assessing depreciation, but our assessment of depreciation assignment online experts use the following four methods to explain every corner of this topic in our assessment of depreciation assignment help.

Like every depreciation method of accounting, this too involves some steps:

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

Our online services on assessment of depreciation also comes along with a number of Assessment of Depreciation assignment examples so that you can understand more concepts in a much better way. Our accounting assignment writing experts cover every topic of this subject. Some of the Assessment of Depreciation assignment samples are given below:

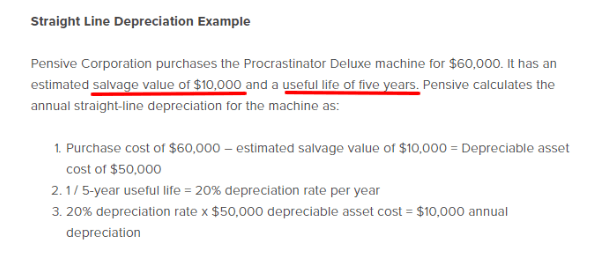

In the above example, the salvage value and useful life in years is already given. With some simple calculations, the final depreciation amount gets calculated after a series of steps. After our accounting assignment experts calculate the final amount, they record this depreciation expense in the debit side of depreciation expenses account and also credit in the accumulated depreciation account in the accounting statements. One important thing to note in our Assessment of Depreciation assignment services is that accumulated depreciation must be paired with and reduce the fixed asset account, hence, our Assessment of Depreciation assignment writing helpers consider it as a contra asset.

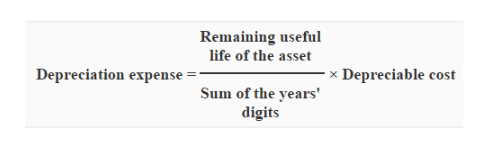

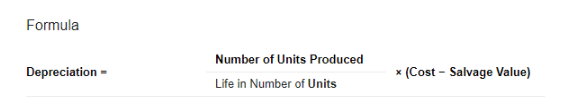

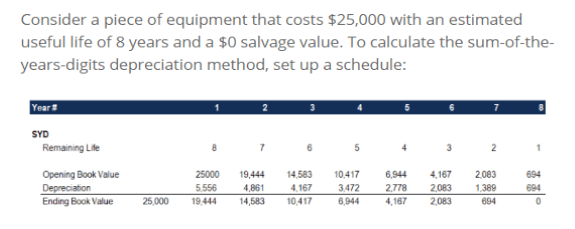

The second example is based on the sum of the years’ digit method of assessing of depreciation. In this question, our online Assessment of Depreciation assignment service experts first calculate the depreciation base, which is a difference between the cost of the asset and salvage value. Remaining life divided by sum of years’ digits will give you the total expenses for a particular year. To attain that figure, this number is multiplied by the depreciating base, and our experts arrive at the final expenses.

My Assignment Services is the most affordable and reliable academic service provider for Assessment of Depreciation Assignment Help. We have an excellent customer service that works round the clock and all days of a year. You can contact our customer care executives and they will address all your queries and concerns and provide you with the most convenient solutions.

We understand that accounting assignments such as depreciation and assessment of depreciation can be a tricky task to do. This is the reason that our accounting assignment writing experts strive to provide round the clock services to our customers, which, are the students. With our unparalleled knowledge of accounting concepts and terminologies, we are your go to place for Assessment of Depreciation Assignment Help.

Our top most priority is your satisfaction and we can provide an initial draft of your assignment. Your inputs are our command; our experts will tailor the assignments as per your suggestions. We will make any number of revisions to ensure that our customers are fully satisfied with our work. To add to that, we will facilitate one-on-one conversations with our experts so that you can directly communicate your requirements to them. Our experts will answer all your questions and clear all doubts that you might have on your assignment.

Our online Assessment of Depreciation assignment help service is 100% authentic and plagiarism-free. We also provide a free plagiarism report along with the assignment which proves that your work is entirely genuine.

1,212,718Orders

4.9/5Rating

5,063Experts

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

FreeBonanza Offer

Get 40% Off *

on your assignment today

Doing your Assignment with our samples is simple, take Expert assistance to ensure HD Grades. Here you Go....